This event serves as a premier platform for industry leaders, stakeholders, and experts to converge and discuss pressing issues and opportunities in the coal, iron ore, pellet, direct reduced iron (DRI), ferrous scrap and steel sectors. With India and China, two of the world’s largest developing economies and coal consumers, navigating energy transition challenges, the conference will delve into ‘multiple energy pathways’ aimed at mitigating carbon emissions while maintaining coal’s crucial role in the energy mix until at least 2040. Discussions will encompass regional supply-demand dynamics, advancements in carbon capture technologies, and the regulatory landscape, providing attendees with invaluable insights into shaping the future of these industries.

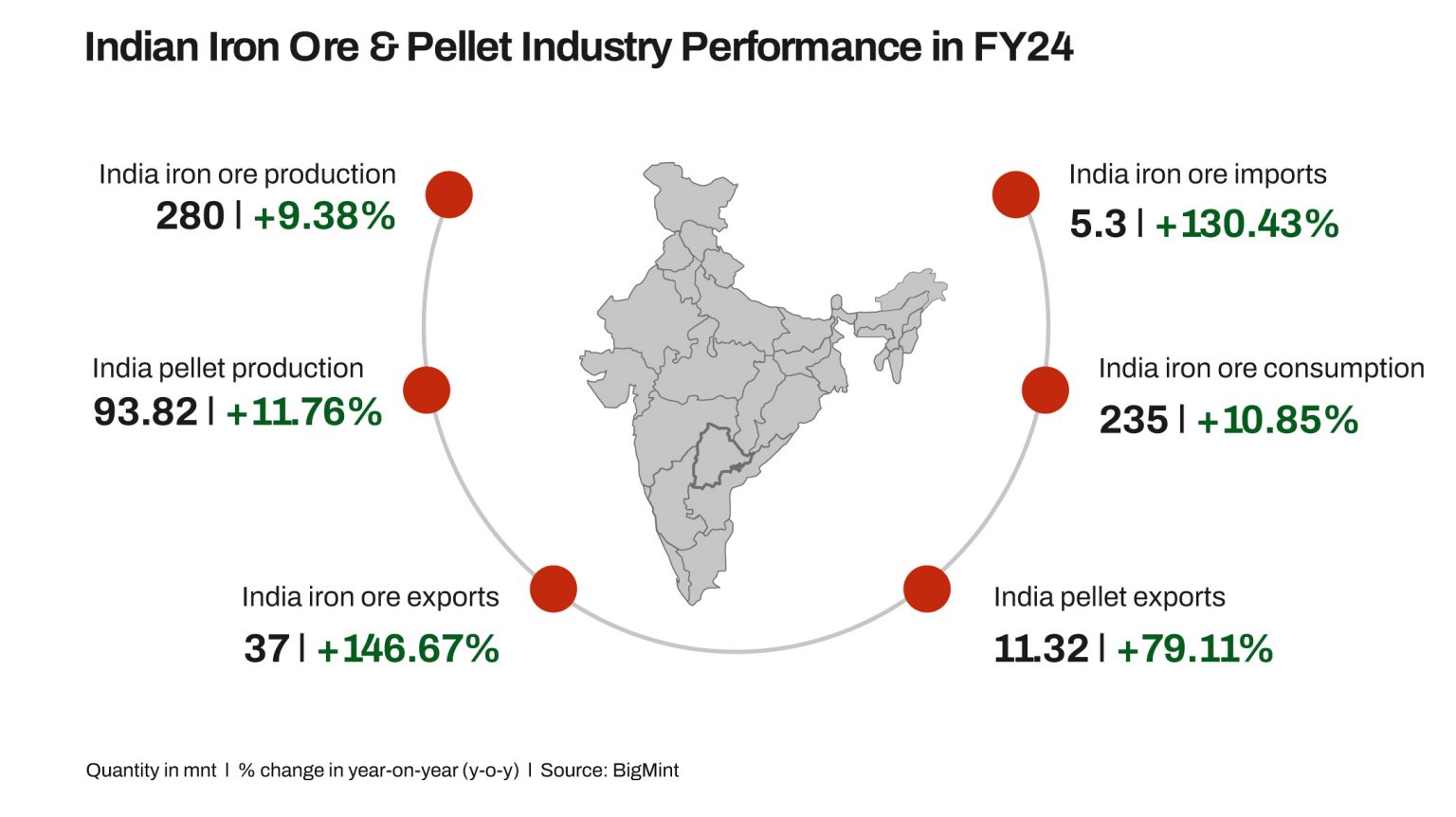

Simultaneously, the event is dedicated to exploring core challenges and opportunities within India’s iron ore and pellet industry. With a focus on demand supply dynamics, policy transformations, and India’s journey towards decarbonization, attendees can expect insightful discussions on global iron ore market trends, future trajectory of imports and prices, and the consequential impacts on the industry.

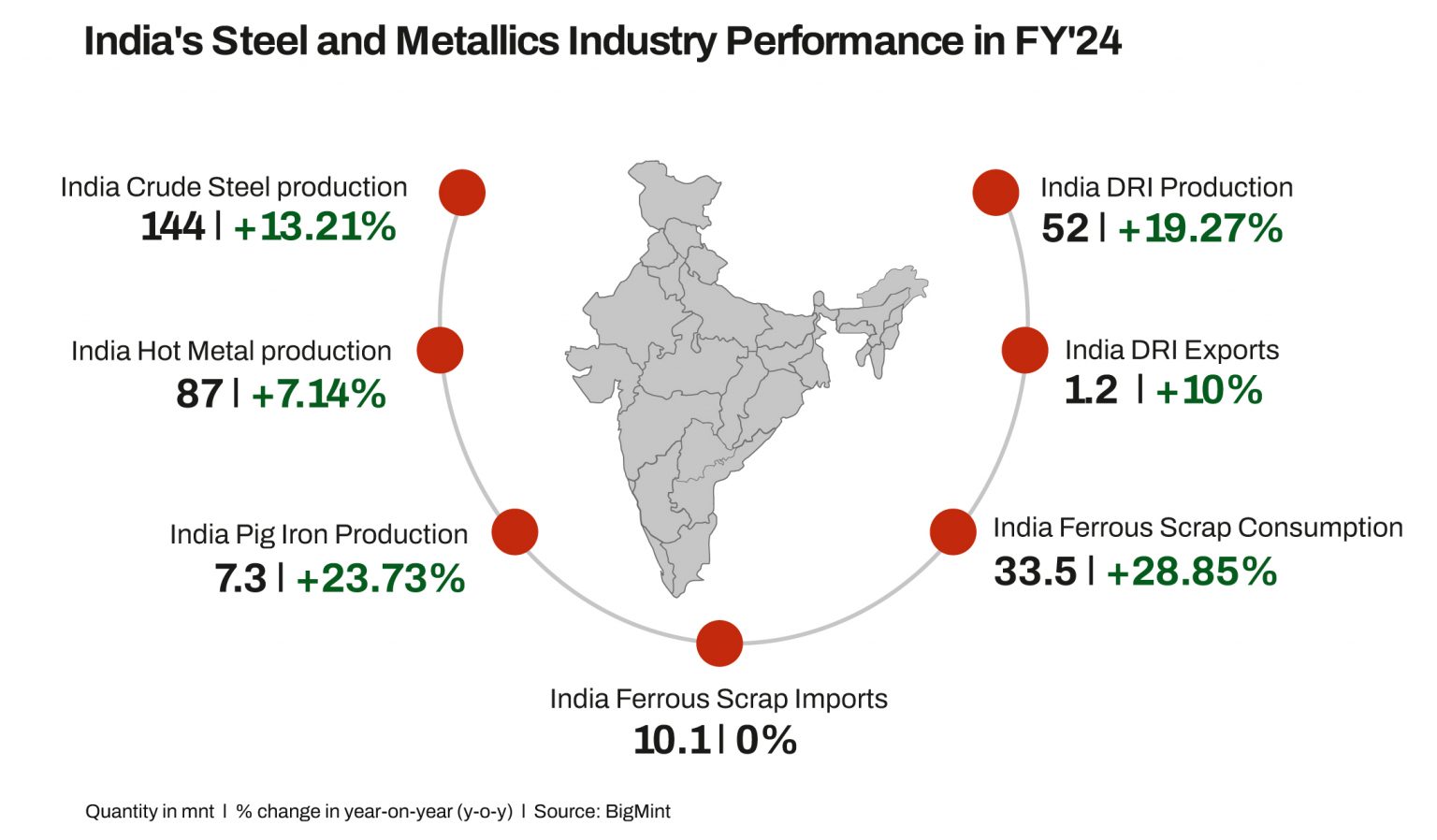

The event will address the growing DRI industry in India, driven by rising demand for sponge iron as a steel production raw material & will also delve into the potential export opportunities. Furthermore, it will explore evolving dynamics in the global scrap market and import opportunities for Indian mills.

This summit is meticulously designed to navigate through the dynamic landscape of demand-supply dynamics, policy transformations, and their consequential impacts on the market. Moreover, it aims to scrutinize India’s journey towards decarbonization while oering insightful discussions on global ion ore market dynamics.

Anticipated discussions will revolve around the future trajectory of iron ore and pellet production, imports, exports and prices, providing attendees with a comprehensive outlook on the industry’s direction.

Steel has been a critical component of India’s economic growth, with the steel industry accounting for a significant portion of the country’s GDP. The future expansion of the Indian steel industry looks promising, with increasing demand for steel in infrastructure development, automotive manufacturing, and construction.

Additionally, the Direct Reduced Iron (DRI) capacity in India is also growing. India’s DRI industry is set to grow at a 6% CAGR by 2030, with annual forecasted production ranging from 65 to 70 million tonnes by FY’30. With the expansion of DRI capacity and improved production techniques, India is well positioned to tap the potential export opportunities.

Furthermore, the global scrap market is constantly evolving driven by factors such as geo-political conditions, trade policies and environmental regulations. This presents new opportunities for Indian mills to import scrap from various sources. India’s increasing steel scrap imports highlight the country’s potential to become a major player in the global steel industry and further boost its economic growth.

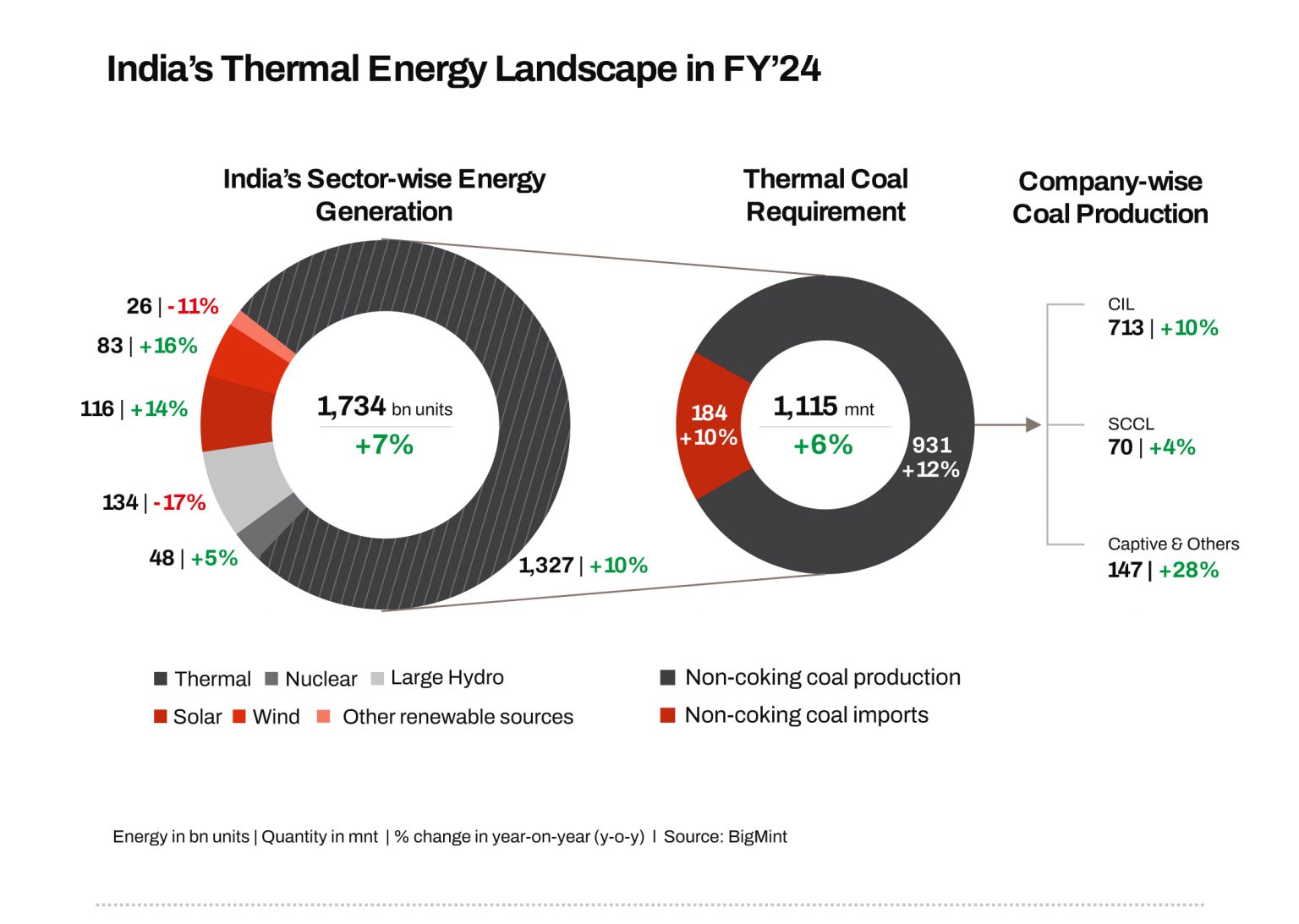

The world’s largest developing economies and coal consumers, India and China, are currently navigating energy transition challenges by adopting ‘multiple energy pathways’ to mitigate carbon emissions, rather than opting for a complete coal phase-out.

India, as one of the fastest-growing economies globally, asserts that coal will remain a crucial energy source until at least 2040, serving as an affordable energy option with demand yet to peak. In this context, government authorities have consistently underscored the importance of coal.

A K Padhy

Executive Director - Commercial & MM

NMDC Limited, India

Abhijit Sur Roy Chowdhury

India Team Leader & Regional

Chief Representative

C&D Steel International, India

Abhishek Agrawal

Executive Director

Godawari Power & Ispat Limited,India

Akhilesh Kumar

Sr. Divisional Head (Strategic Procurement & DRI Sales)

Tata Steel Long Products Limited

Amita Khurana

Group Chief- Raw Materials Procurement

Tata Steel, India

Dr. Aruna Sharma

Former Secretary Steel

Govt. of India

Abhishek Tulsian

Director

Ashok Steel Industries Pvt. Ltd.

D P Deshpande

Strategic Advisor - Consultant

India

Gunmeet Singh

Head of Ferrous Origination

Vale, Singapore

Hrishikesh Kamat

Chief Procurement Officer

ArcelorMittal Nippon Steel, India

Kapil Mantri

M & A

Jindal Steel & Power (JSP), India

Manish Gulati

Director – Commercial

Interocean Shipping,India

Manish Mishra

Chief Corporate Affairs

Tata Steel, India

Mridul Agarwal

Executive Director

Shakambhari Group

Navin Jaju

Chief Executive Officer

Vedanta Sesa Goa, India

Nirmalya Deb

Executive Editor

BigMint, India

Nishtha Mukerjee

General Manager - Operations

BigMint, India

Priya Ranjan Prasad

Director - Steel Making

Lloyds Metals & Energy Ltd, India

Puneet Jagatramka

EVP - Raw Materials & Opex

JSW Steel, India

Rajesh Gupta

Managing Director

Lloyds Metals & Energy Ltd, India

Rahul Gupta

Chief, Steel Recycling Business

Tata Steel Limited, India

Dr. Rajesh kumar Singh

Sr. Director - Consulting Business

Development & Service

India & South

East Asia, Sphera, India

Sachin Shetty

Managing Partner

Quesrow Consulting, India

Siddharth Sud

Physical Coal Trader

ITOCHU, Singapore

Tushar Chakraborty

Director

Deloitte, India

Vivek Nishant Nath

General Manager (Sales & Marketing)

Odisha Mining Corporation

Yashraj Petty

Executive Director

SRJ Petty

Zain Nathani

Managing Director

Nathani Group of Companies

Zoljargal Zolo Jargalsaikha

Executive Director

Mongolian Coal Association, Mongolia

|

|

|

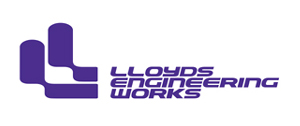

India's ferrous scrap imports are likely to see a significant over 30% decline to ~7 million tonnes (mnt) in financial year 2024-25 (FY'25) compared to 10 mnt in the previous fiscal, as per BigMint's analysis.

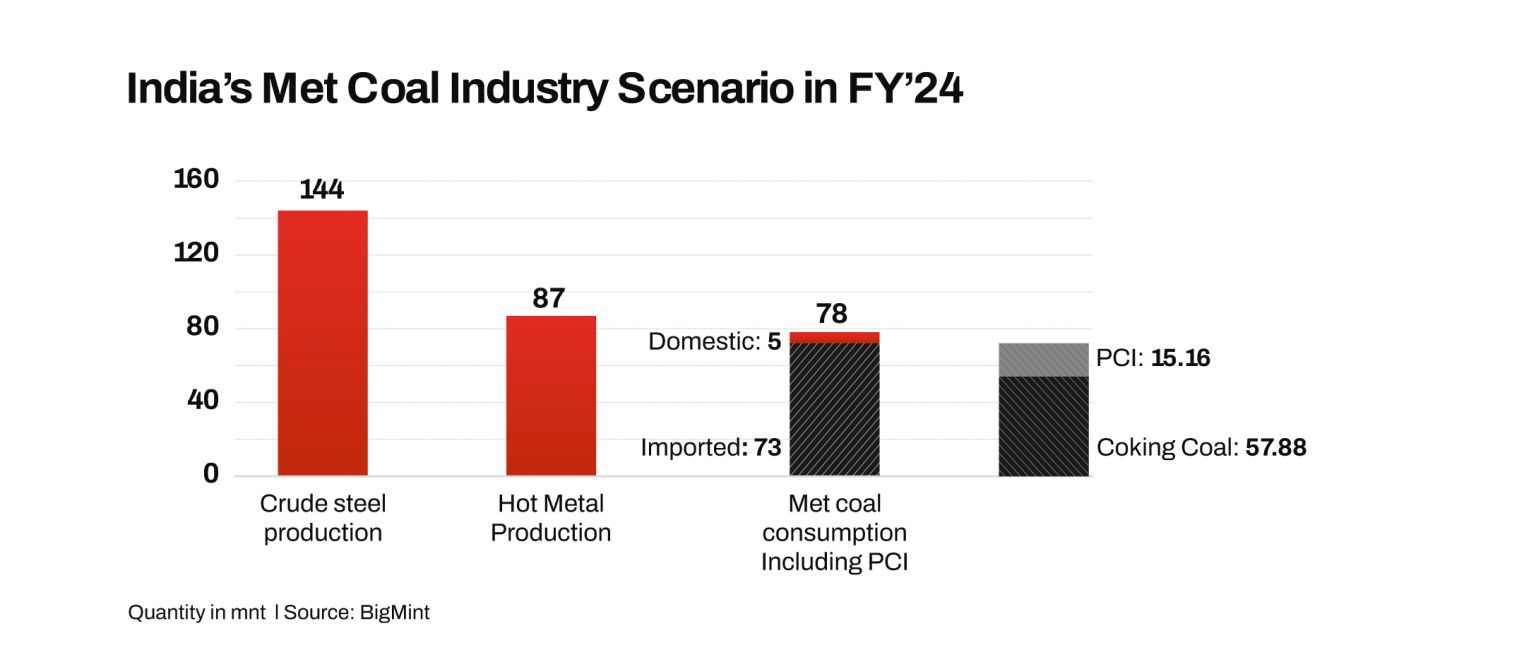

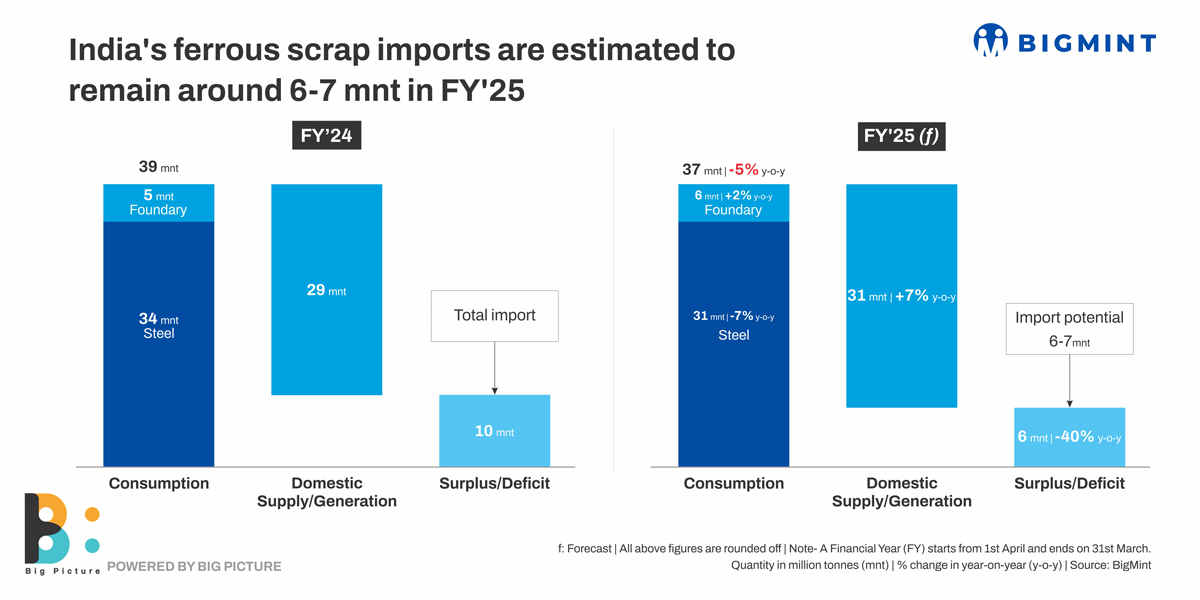

India's imports of metallurgical coal in January-May 2024 (5MCY'24) stood at 31.7 million tonnes (mnt), an increase of 9% y-o-y compared with 29.1 mnt in 5MCY'23 as per BigMint data, on higher crude steel and hot metal production.

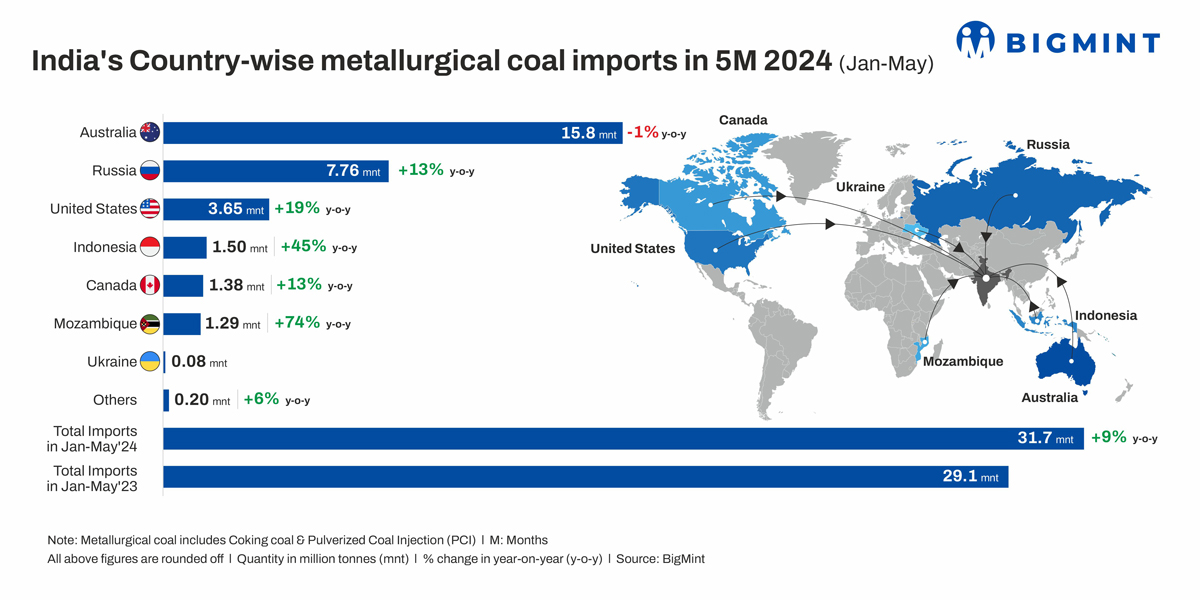

Global seaborne metallurgical coke export volumes decreased around 5% y-o-y to 27 million tonnes (mnt) in 2023 from around 28.5 mnt in 2022, as per provisional data available with BigMint.

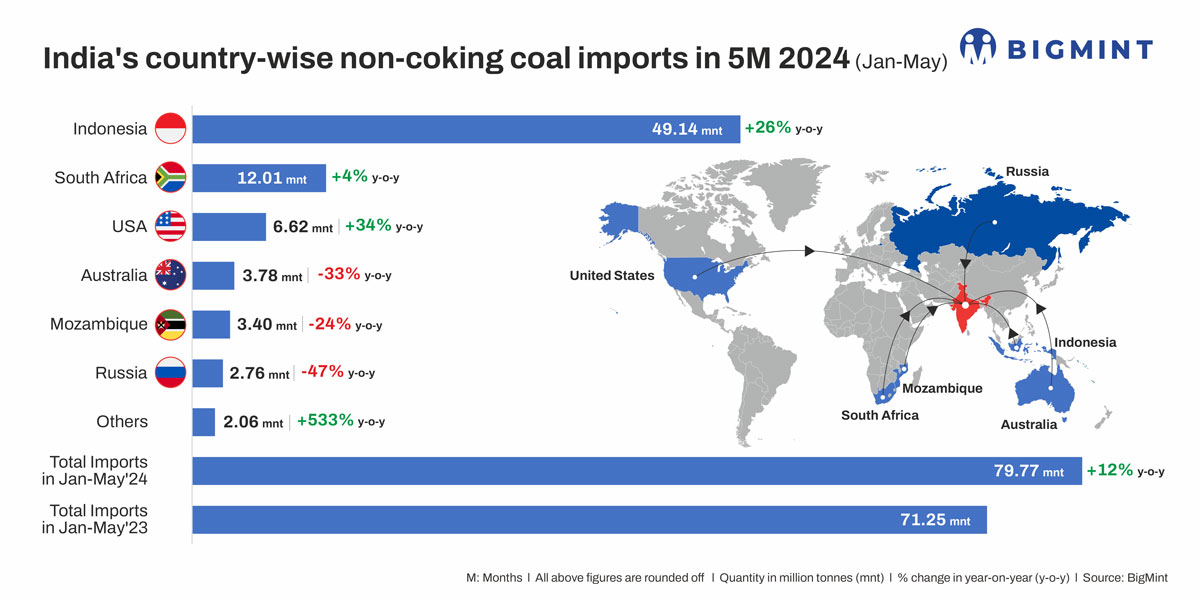

India's imports of non-coking coal, largely used in power generation as well as other industrial applications, increased by 12% y-o-y to nearly 80 million tonnes (mnt) in January-May 2024 compared to a little over 71 mnt in the same period of last year, as per data collated by BigMint.

Ajeet Singh

Email: ajeet@bigmint.co

Mobile:+91 9009222344

Vinamrata Jaisinghani

Email: vinamrata@bigmint.co

Mobile: +91 62637 51163

Faizan Raza

Email: faizan@bigmint.co

Mobile: +91 9575100430